The Family Business Nation™️ Radio Show: 2017

Dec 27

2017

Introduction

Les was looking down the barrel of a gun

Interview with Les Gold and Seth Gold -- co-owners of American Jewelry and Loan, and stars of the reality TV show "Hardcore Pawn." Dealing with fear. The drive is in your heart. Les learned from his grandfather: family is number one; work hard; give the customer a fair deal. Seth wanted to come to the business and help, and to work with his father. Seth sees passion and drive in his father. Les: “How bad you want it?” (7:10)

“How bad do you want it?”

“How bad you want it?” In life, do you want to be successful? Do you have drive and desire? Seth started in the warehouse for a couple of years, learning the business from the ground up. He has brought new ideas, like selling on the Internet, and streamlining processes. Existing employees wonder why things need to change to new and innovative ways. The “buy-in“ for new ideas needs to start with Les. You need to build a case for change, and not everything will be adopted. At work Seth calls his father “Les” rather than “Dad.“ You need relationships built on trust, so it is not good to go behind each other‘s back. When they are at work, Les is the boss. Otherwise he’s dad. (9:57)

A family business bringing their expertise to the community.

25 million people don’t have access to traditional banking. Les and Seth host financial literacy courses. They partner with the Jalen Rose Academy charter school. They employee autistic adults. They have built a good team with attorneys, accountants, and wealth managers for their succession planning. Les does not plan to retire. He works seven days a week during the holidays. “How bad you want it?” People see it in Les. It doesn’t matter what you do, it’s the drive that keeps you going. Seth has “Goldtone Podcast” at SethGold.com. Les was a born salesman, and started selling as a kid, but he also learned how to sell from another employee who was great at sales. Sales is about building relationships and trust in order to get return business. (11:05)

Plan for someone dying unexpectedly – or your business and family can be devastated.

Sean Cook is an attorney with Warner Norcross and Judd. He worked with a family business owned by two siblings. They did not do any serious succession planning. One sibling died suddenly, which left a lot of uncertainty, distrust and stress. It was devastating to the family, who no longer speak to each other. It was a huge distraction to the business. Business plans could not be implemented. Family businesses need to put in-place safety measures in case someone dies unexpectedly. They should have family meetings. It is comforting to the family when you plan ahead regarding succession of management and ownership. (8:19)

Nov 29

2017

Introduction

“Treat them like they are in your living room.”

Interview with Hal Dittrich and his son's Jason and Shawn of Dittrich Furs. Founded in 1893, Dittrich Furs is the oldest family-owned retail business in Detroit. The secret to their longevity? Serve the customer. “We do everything we can for the customer. There’s no charge for moving buttons or anything like that. We have our own credit system.” The way the customer shops has changed. Customers used to sit down, and sales people modelled the coats. Now customers want to move more quickly and look through the racks -- we are there to help them. Hal’s grandfather said “When a customer is in the store, treat them like they are in your living room.” We train employees on how to serve the customers. Members of the next generation of the family are not required to enter the family business. After graduating from college, they work elsewhere first. Jason entered the business because: “It seemed comfortable, and I could steer my life and career.” Shawn entered the family business: “because of the family business age and legacy.” (7:21)

“Listen to each other – not just to what you are thinking.”

Jason and Shawn would come to the business as children before Christmas to go on deliveries, sweep up the shop, and run errands. Hal: “This was done by my father, and his father.” Hal and his father almost left the family business, and separated from Hal’s grandfather and uncles, because promises were not being kept. Jason and Shawn know that there will be arguments between them. The three family members don’t make decisions without all three of them being involved. Hal’s advice: “Listen to each other in the family, and evaluate what the others are saying, not just what you are thinking.” (10:55)

The Big Five Family Business Stories

The Big Five Stories -- five of the latest stories you should know about from the world of family business. Story Number Five: The Marriott family focuses on employee well-being. Do family businesses care about employee well-being? Story Number Four: American Jewelry and Loan leads a workshops on financial literacy. Are family businesses more involved in the community? Story Number Three: An article in Forbes magazine said that you should do employment planning before succession planning. Is this a best practice? Story Number Two: Meijer is opening their third grocery store in Detroit. Are family businesses helping with the renaissance of Detroit? Store Number One: Ford Motor Company has recently promoted five women into senior leadership positions. Are family businesses a good place for women’s careers? (8:53)

Co-Presidents and Co-CEOs

Interview with Adam and Jacob Bishop, Co-Presidents and Co-CEOs of “Elite Mr. Alan’s.” Adam and Jacob were recently name to the Crain’s Detroit Business 40 Under 40 list of young business leaders. Brick-and-mortar retailers are healthy -- when you are speaking directly to the customer base. How to be Co-Presidents and Co-CEOs? We use our strengths to benefit each other. Adam and Jacob started out by opening a similar business in Florida, and later merged with their father’s business. The business has evolved from the price point store to high-end products. Their father mentored them regarding business metrics, key performance indicators, and how to get the newest and hottest brands. Their father taught them to never let a brand say “no“ to you. He also taught them to always keep the customer in mind, because the customer has a choice every day. (9:12)

Oct 25

2017

Introduction

FISHS: financial capital; intellectual capital; social capital; human capital; and spiritual capital.

Interview with John Rakolta Jr. – the CEO and Chairman of Walbridge, and two of his children: Lauren Rakolta, president of DFM, and John Rakolta III – known as J.R. J.R. has recently been promoted to executive vice president and chief administrative officer of Walbridge. Our family capital can be described using the acronym FISHS: financial capital; intellectual capital; social capital; human capital; and spiritual capital. We also use the model of a three-legged stool with the legs of: spiritual, physical and intellectual. For our first family meeting, rather than focusing on financial capital, we focused on FISHS and the three-legged stool – and what our family is going to stand for in the long-term. J.R.: “I always wanted to work with my father, even as a child. All of the children wanted to do something with him.” (9:30)

1.5 day family meeting every year for 13 years

For 13 years we have been meeting yearly as a family for a 1.5 day retreat. We address a different issue at each meeting. We do this because we realize that our family is linked to our business. John Jr. gives his children “runway to lead by our own behaviors. He never made us lead like him. We need to be authentic.” The children’s mother has been the “glue” and makes sure that no one is left behind. She has been a great advocate for the children. The Myers-Briggs Type Indicator has been a good way for us to learn how to deal with our differences. (10:32)

Afraid to reveal family wealth to the next generation

“The business of the family is the family.” John Jr. was able to share 3,000 meals with his father over the course of working with his father for 30 years. John Jr. wanted the same opportunity with his children. John Jr. was reluctant to start family meetings talking about financial capital, for fear that his children could become “trust fund children.” Starting the discussions with family mission and values left him comfortable with sharing everything with his children. This process involved hurt feelings and disappointed expectations – but these bring the family together. Walbridge has a core value of giving back to the community. (5:45)

LOTS of scheduled family meetings

Interview with Quinn Kiriluk, vice president of development for the family business Kirco Development – and recently named to the Crain’s Detroit list of “40 Under 40” young business leaders. The value of a strong work ethic was instilled at a young age. The children started to work in the business at 12 years old – changing filters; cleaning restrooms; painting handrails. At the family cottage the family did a lot together as a family. Quinn, his brothers and their father meet every six weeks for a casual breakfast to discuss both business and personal issues. They meet bi-annually as a family for family strategic planning meetings: once per year with just the father and sons in the business; once per year also including the spouses so everyone is on the same page. When there are differences of opinion between family members in the business, they are handled openly, collaboratively, and constructively – without raised voices. (10:07)

Sep 27

2017

Introduction

Growing up with a sense of entitlement

Interview with Frances Stroh, fifth-generation member of the Stroh Brewery Company and author of "Beer Money: A Memoir of Privilege and Loss." Growing up with a sense of entitlement. Men forced to work in the family business and not allowed to follow their passion. Leads to less than competent leaders. Leads to emotional bankruptcy as well as financial bankruptcy. Recommends sending younger generation out into the world to figure out who they are -- without financial support. To build "grit" and a sense of identity. (8:20)

The difficulty of passing on values to the next generation

Continuation of interview with Frances Stroh. There is less of an attitude of entitlement when the younger generation is expected to go out on their own. The founder of the family business had values of hard work, persistence and frugality. It is difficult to pass these values on to future generations. (11:12)

Finding forgiveness

Continuation of interview with Frances Stroh. She always saw wealth as an impediment to happiness. Finding forgiveness. Her father receiving the news that there will be no more dividend payments. How Frances became an entrepreneur. Her support for "826 Michigan" -- a non-profit supporting tutoring for underserved children. (9:29)

Tips on entering the family business

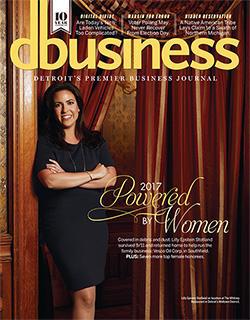

Interview with Seth Gold, of American Jewelry and Loan and the TV show "Hardcore Pawn" -- and recipient of "Thirty in their Thirties" award from DBusiness Magazine. On entering the family business, needed to demonstrate to other employees a level of competence. Entered the business working in the warehouse -- not at a management level. Brings some new and different ideas to the business, e.g., internet and social media presence; mobile pay. Always looking for ways to expand the brand -- while keeping within one's area of expertise. (7:06)

Aug 30

2017

Introduction

Next Gen as entrepreneur

Interview with "Next Gens" Anthony Ahee (Edmund T. Ahee Jewelers), Jennifer Jackson (Hungry Howie's Pizza), and Duncan Smith (All Star Services). What does being an entrepreneur mean? Getting outside the box. It requires an innate ability, and an ability to be coached and developed. It is being a self-starter. It means focusing on profits, but especially in a family business it means focusing on the long term. Are you a "franchisee" or an entrepreneur? There needs to be a good balance of family and business, and an ability to leave work at work. Family businesses have passionate people at all levels, including a passion for customer service. The next gens are bringing new ideas. You need both generations to listen to each other. (9:22)

You need to be able to win over the managers

Who do you have to win over? To whom do you have to demonstrate that you are a competent leader? You need an ability to be mentored and to mentor others. You need to win over managers, and support them. There needs to be both formal and informal development of the next generation. You need to be able to receive constructive feedback from family members. (7:52)

The mechanics of transferring ownership to the next generation

Interview with attorney Sean Cook with Warner, Norcross & Judd. Transferring ownership to the next generation. You need the right people to receive the business. You need to focus on the business, not just on the family. It is important to manage taxes in the transfer of ownership. Seller financing includes a risk to the seller. The use of external advisers and consultants. Bank financing of the transfer often includes using the business as collateral. (8:58)

It can take years to develop a leader

When the leadership team includes non-family members, it brings diversity of thought. Customer first. The next generation can show leadership on the leadership team. The next generation can continue the values of the founder. It can take years to develop a leader. The next generation needs to be patient and humble in their learning. (8:51)

Jul 26

2017

Introduction

Balancing the different “hats”

Interview with Steve Jackson (President and CEO); Jennifer Jackson (VP of Franchise Development); and Sarah Jackson(Controller) of Hungry Howie's Pizza, Inc.: Balancing "hats" of father and CEO. Next generation making their own "mark" in the business. The role of "Mom" as gatekeeper between family members. "Mom" as "Chief Emotional Officer." (9:22)

Pick a charity which is important to everyone in the organization

Continuation of interview with Hungry Howie's Pizza: Separating business and family. Next generation has to earn respect because others assume they are given their position due to their last name. Sibling competition. Community involvement: pick a charity which is important to everyone in the organization -- National Breast Cancer Foundation. (9:27)

Father/president incredibly gracious and generous regarding transition

Co-hosts continue discussion regarding Hungry Howie's Pizza: How a "big personality" founder avoids overpowering other family members. "Behind every successful man there is a strong woman." Role of "Mom" as "glue" in the family business.

Interview with Lilly Epstein Stotland -- newly appointed president of Vesco Oil. Being humble and appreciative with new appointment. Wish could share success with grandfather. Majority woman-owned business. Father/president incredibly gracious and generous regarding transition. (8:35)

Interview with Lilly Epstein Stotland -- newly appointed president of Vesco Oil. Being humble and appreciative with new appointment. Wish could share success with grandfather. Majority woman-owned business. Father/president incredibly gracious and generous regarding transition. (8:35)

How can the second generation purchase the family business from the first generation?

Question and Answer Segment:

Q: How can the second generation purchase the family business from the first generation?

A: Gifting. Valuation issues. Selling at a discount. PNC does shareholder loans for successors. Gift shares and purchase more shares with dividends. Importance of a written plan. Use expert consultants.

Q: My son has a sense of entitlement.

A: Next gens may feel that they are already working hard. Report to non-family manager. Work outside of the family business. Have to earn the right to leadership. Clear performance improvement plan. (8:51)

Q: How can the second generation purchase the family business from the first generation?

A: Gifting. Valuation issues. Selling at a discount. PNC does shareholder loans for successors. Gift shares and purchase more shares with dividends. Importance of a written plan. Use expert consultants.

Q: My son has a sense of entitlement.

A: Next gens may feel that they are already working hard. Report to non-family manager. Work outside of the family business. Have to earn the right to leadership. Clear performance improvement plan. (8:51)

Jun 28

2017

Introduction

The business is bigger than the family

Interview with Bill Parlberg (President and CEO); Martha Zehnder Shelton (CFO); and Susan Zehnder (VP of Human Resources) of Zehnder's of Frankenmuth: What is the magic? Every guest is celebrating something -- it is not just another dinner. Balance between maintaining tradition and staying relevant to new generations. Customer service philosophy taught to all employees by the CEO: "Every guest leaves satisfied." Being both a mother/aunt and a boss. The business is bigger than the family. Family members must all do their fair share. Family members need proper qualifications and ability to be given a job. Managers are a mix of family and non-family. Senior management team must all have at least a bachelor's degree. The management team mentors the next generation of leaders -- both family and non-family. (10:20)

Voting shares are limited to family members who are managers

Continuation of interview with Zehnder's: Balancing tradition and new ideas -- in addition to the restaurant, have added a cafeteria, Splash Village Water Park and hotel, a marketplace, and The Fortress golf course. Family members are assigned roles based on strengths. Resolve conflict and differences of opinion based on open communication and looking at others' perspectives. All have same vision and goals for the business. Bill (CEO) does annual performance reviews for next generation family members and senior managers. Ownership is limited to family members. Voting shares are limited to family members who are managers. (11:08)

When a family member is falling short

Co-hosts continue discussion regarding Zehnder's: Teaching the customer service philosophy through training and role modeling. When a family member is falling short. Next generation family members reporting to non-family members. Getting help from consultants for family business conflict. (7:09)

Differentiate between planning for succession of ownership and succession of management

Question and Answer Segment:

Q: How long does successon planning take?

A: Need to differentiate between planning for succession of ownership (shares) and planning for succession of leadership and management. Developing the next generation for leadership and management takes years. It also takes time for the senior generation to get comfortable with the next generation as leaders, and confortable with the transition. Requires a systematic development plan with consistent evaluation and feedback. Requires humility on the part of the senior leader.

Q: My father is constantly shooting down my ideas.

A: Think through a question/idea before you share it. Present ideas as part of a group. (7:26)

Q: How long does successon planning take?

A: Need to differentiate between planning for succession of ownership (shares) and planning for succession of leadership and management. Developing the next generation for leadership and management takes years. It also takes time for the senior generation to get comfortable with the next generation as leaders, and confortable with the transition. Requires a systematic development plan with consistent evaluation and feedback. Requires humility on the part of the senior leader.

Q: My father is constantly shooting down my ideas.

A: Think through a question/idea before you share it. Present ideas as part of a group. (7:26)

May 31

2017

Introduction

What does a family office provide for high net worth clients?

Interview with Steve Appledorn, Karen Collingsworth-Crusse, Christie Evey, and Nazneen Syed of Hawthorn Family Office: What does a family office provide for high net worth clients? How does a wealth strategist serve high net worth families? What does it mean to be a fiduciary advisor to a high net worth family? (10:18)

The concerns of ultra-high net worth families

Continuation of interview with Hawthorn Family Office: Designing investment solutions for ultra-high net worth clients. Working as a team with other professional service providers. The concerns of ultra-high net worth families. Decisions based on values of the family. Bringing professional expertise and objectivity. (10:07)

A coordinated team approach in a multi-family office

Co-hosts continue discussion on the multi-family office: A coordinated team approach. Typical clients. Philanthropy and family foundations. (7:25)

Buy-sell agreements

Interview with Sean Cook, attorney with Warner, Norcross and Judd: Reasons to create a buy-sell agreement. What can happen if a buy-sell agreement is not in-place? When does a business create or revise their buy-sell agreement? Life insurance to fund the buy-sell agreement. (7:50)

Apr 26

2017

Introduction

Managing conflict

Interview with Marjory Epstein and Lilly Epstein Stotland of the Vesco Oil Corporation family business: "We don't lead Vesco Oil -- leadership comes from the family, the management team, and from all employees"; managing conflict; taking the time to listen, discuss and understand; senior generation slowly reducing their role; which "hat" are you wearing (e.g., mother or executive); family meetings (7:30)

Utilize the strengths of every employee

Continuation of interview with Marjory Epstein and Lilly Epstein Stotland: Veso Oil's 70th anniversary; "talking" to family business predecessors; "We love everyone we work with"; utilize strengths of every employee; company values. Further thoughts from the hosts: living by values; respect; family meetings; "hats" (10:02)

Mistaken assumptions regarding insurance coverage

Interview with Britton Steele, CEO of Provision Insurance Group: business insurance versus personal insurance; should review person insurance every year; mistaken assumptions regarding coverage, e.g., liability; texting and driving; exploring client's needs; liabilities with boating (9:20)

Asset protection

Businesses need to protect themselves from personal liability as well as business liability; using entity structure and trusts for asset protection; Hawthorn Family Office looks beyond investments to the whole picture of protecting assets; annual review of personal insurance; family business values; "hats", Conversational IQ dashboard; valuing all employees (9:21)

Mar 29

2017

Introduction

Learning to work in the family business

Interview with Peter Ahee and Anthony Ahee of the Edmund T. Ahee Jewelers family business: customer experience; exceeding expectations; learning to work in the family business (6:36)

Deciding to work in the family business

Continuation of interview with Peter and Anthony Ahee: deciding to enter the family business; handling differences of opinion; developing the next generation; use of professional service advisors. Further thoughts from the hosts: family meetings; values of the family in the business; role of philanthropy in a family business (8:57)

What gets in the way of family business transition?

Interview with Sean H. Cook, an attorney with Warner Norcross & Judd LLP: the attorney's role in family business transition; common scenarios and what gets in the way of transition; family meetings facilitated by the attorney; the attorney working with other professional service providers; deciding who should be involved in the family business and who should lead the family business (10:19)

Why families delay difficult decisions

Why families delay difficult decisions Regularly scheduled family meetings; effective family communication; starting with family values; special value of the family office; buy/sell agreements; putting it in writing -- and why families delay difficult decisions; problems can be portals (10:24)

Feb 22

2017

Introduction

Succession planning

Succession planning. (7:03)

Transfer of wealth

Transfer of wealth. (9:49)

Team building

Team building. (9:21)

Exit planning

Exit planning. (10:03)