The Family Business Nation™️ Radio Show: 2018

Dec 26

2018

Introduction

Siblings grew up learning to work together.

Ryan LaFontaine and Kelley LaFontaine are second generation members of the LaFontaine Automotive Group. (How did growing up together help you?) We were raised to protect each other and love each other. We learned under male and female tutelage. Our mother was “wowing“ the customer. Our father focused on sales and relationships. As siblings we get along great. Kelly took time away to raise children. It’s hard to find balance between work and family. When Ryan was going through his cancer that added to the challenge. (When Ryan was ill?) I was proud of Ryan, he kept wanting to work, and never missed a day. He was an inspiration.

Lessons learned from serious personal illness.

(Why was it so important to never miss a day at work when you were sick?) We were building our flagship store. Is something up I was proud of. God gives you lessons. I was working too many hours. I had to be vulnerable and tell our employees of my cancer. Employees rallied behind me and encouraged me, so I wanted to be there and stay positive. I learned that it’s OK to delegate. (What are Kelley's strengths?) We have always had a close bond. She is a grounding force to balance Ryan’s leading with heart. We share everything. We don’t have secrets. We need to be able to have good and bad conversations and stand together. (What are Ryan's strengths?) Kelley looks up to Ryan. He inspires employees. He leads with his heart.

Effective sibling communication.

(How do you go about giving each other difficult feedback?) We sit next to each other every day. We travel together. We take time to sit down to have difficult conversations, without animosity. (How about receiving feedback?) You have to respect the person giving the feedback, and give them time to get it out. Be patient. Then ask questions. Sometimes I need to step away and think about it. Together we are stronger than as individuals. We had good communication even before working together. (How do you split up the work?) We’re together almost all the time. We travel to stores, and are in meetings together. Our parents made sure that we cared about each other. (What did you learn from your parents?) They taught us faith, family and friends. Unconditional love. (Are your parents giving you autonomy?) It’s our family's business. We learn to let go and delegate and see others thrive and grow. Our parents are still active today.

Family meetings and ownership transition.

(Do you have family meetings? Do you have a vision and values?) We call family meetings when we need them: Where do we want the business to be in five years, so we are aligned? We have family time and don't talk about work. Faith, family and friends in that order. We go 4-5 days off site with our general managers. Our father is there the whole time. (Who has ownership in the business?) Kelley, Ryan, and our parents have ownership. There has been gifting. We have LLCs, corporations, and life insurance. It’s hard to talk about life after our parents. Kelley and Ryan discuss it. If you wait, it’s too late. Business and laws change frequently. We have siblings who are not part of the business, so we need to fulfill our parents intentions. We can’t predict the future, like what children will want to enter the business. (What has your been your philanthropy in the area of cancer?) Ryan had cancer in 2008. We make grants locally in Michigan. Grants to find a cure. Our parents were always involved in the community. We meet with the researchers.

Nov 28

2018

Introduction

Entrepreneurship in a family business.

Focus on entrepreneurship. Family businesses need to reinvent themselves in every generation -- because of changes in the environment; technology; competition, etc. Often the second generation is not entrepreneurial. You need to be able to risk, fail, and recover from failure. Can the entrepreneurial mindset be taught? Sometimes the senior generation squashes the entrepreneurial mindset in the next generation. The DNA of the entrepreneur is finding ways to make things better.

Scott Leibovitz is vice president at Ari-El Enterprises. His father, the founder of the business, has been entrepreneurial. In the 2008 downturn, they looked for opportunities to acquire properties.

Scott Leibovitz is vice president at Ari-El Enterprises. His father, the founder of the business, has been entrepreneurial. In the 2008 downturn, they looked for opportunities to acquire properties.

The next generation bringing change -- while respecting history.

Scott was entrepreneurial as a child. As he entered the organization, he asked “How can I make the organization better? How can I make our tenants happier? How can I better manage our assets? How can I get out of day-to-day operations to focus on acquisitions and growing the business?"

Ryan Maibach is president of Barton Malow. When he became president he had to balance the good that already existed with the need for change. He was aware of challenges in their industry as a whole. They looked for ways to improve their company and their industry. They built a “case for a change.“ They kept track of changes in the industry and the economy. They saw a disruption. Their “case for change“ validated the reality of the future and balanced it with their history. How do we need to change to remain relevant?

Ryan Maibach is president of Barton Malow. When he became president he had to balance the good that already existed with the need for change. He was aware of challenges in their industry as a whole. They looked for ways to improve their company and their industry. They built a “case for a change.“ They kept track of changes in the industry and the economy. They saw a disruption. Their “case for change“ validated the reality of the future and balanced it with their history. How do we need to change to remain relevant?

A crisis can force strategic and entrepreneurial thinking.

For their “case for change“ they had to balance their level of pride in the history of the organization with the need for change. This was not a static document. It was modeled off Alan Mulally at Ford: a weekly leadership meeting. They discussed what they were reading and observing. They identified implications for the company, and required modifications to their strategy. When Ryan became president: there was a mild “crisis“ which forced him to look at the challenges. In the long haul, where we going? What is our long-term goal? “Entrepreneurialism“: identify a need and opportunity for change or new ventures. Every business needs to be entrepreneurial. (Reinvent the family business in every generation?) A difficult period forced the introspection and necessary changes. (Did your father prepare you to be an entrepreneur?) My father was always open and transparent, and willing to talk about the good and bad he was experiencing. We had many Saturday breakfasts discussing the business.

Tips for family business.

Three tips for travelers in Family Business Nation. 1. Existing generation needs to create an environment for the next generation to develop the entrepreneurial mindset. 2. This requires multiple skills: courage and being calm. Co-creating and integrity to follow-through. Creativity and critical thinking. 3. Look externally for trends and look internally. SWOT analysis.

Oct 26

2018

Introduction

The power of strategic planning.

Recorded at Hungry Howie’s Pizza Test Kitchen. Jennifer Jackson, Vice President of Development at Hungry Howie’s. Family businesses need guidance from the family business perspective: communication; boundaries between the business and personal. We’ve been busy with the pink pizza boxes and the Love, Hope and Pizza Campaign for breast cancer. Donald Levitt on strategic planning for family businesses: The first generation may not need formal strategic planning, but later generations do need it, but may not recognize the need because they did not see it in earlier generations. Strategic planning can help a company to grow revenue and profits. Formal strategic planning gets the whole team on-board. All decisions are made in alignment with the strategic plan. (9:01)

One company’s story of strategic planning.

Nick Kaufman and Brian Kaufman with Kaufman Engineered Systems. They just conducted their first strategic planning process in 20 years. (Why did you do strategic planning?) We had 50% growth in revenue in one year, and ended up with all of our teams disconnected, and inefficiencies, and not as profitable as anticipated. If Purchasing, Service, etc. knew that we were going to grow like that, they would have made different decisions. Turnover was a spur for us to look at what we were doing. Our strategic planning process revealed key opportunities, and then we presented the strategic plan to the board. We have monthly follow-up meetings to hold each other accountable for executing the strategic plan, plus weekly tactical meetings to monitor our progress, and we have quarterly “rocks.” Managers feel like they have a voice. (11:00)

Three videos on family business.

Videos recorded at a Family Business Nation workshop at Hungry Howie’s Pizza: (1) Gaining traction for change, with Nick Kaufman. (2) Communication in the family and family business, with Jennifer Jackson. (3) Succession planning with Brian Kaufman. (9:26)

Three practical family business tips.

(1) Taking full of advantage of being in a family business. It is hard to let go of your ego. It’s about the success of your family as opposed to just your business. (2) Making time to confront difficult issues. Procrastination about problems is not your friend. Strategic planning is doing what is important but not urgent. (3) Family businesses can learn from each other, so they do not feel alone. (6:54)

Sep 26

2018

Introduction

How to sell a family business.

Joe Fahey is National Director of Business Succession Planning at PNC Bank. Regarding selling a family business to an outside buyer: this decision is fraught with a lot of emotion. It will likely be the largest financial transaction of one’s life. One should start early, and consider all of the options. You need to consider the numbers: the balance sheet, cash flow, asset protection, etc. Make sure the exit plan is a good fit for the owner. There is a difference between cash and cash flow. Sometimes, after running the numbers, the owner decides to keep the business, grow it, and then get a higher value later, because the interest on the cash is less than the current cash flow. (7:16)

How an ESOP works.

Julie Williams is a Managing Director and Nation Lead for ESOP Solutions at PNC Bank. An ESOP (Employee Stock Ownership Plan) is a qualified stock ownership plan. It is used as a way for family business owners to sell stock to employees. An ESOP could be a good fit if the goals of the family are to: maintain ownership in the family; maintain support for employees, the legacy, and the culture; and when price is important but not the most important issue. The owner does not need to lose control the business. The employees do not pay for the shares. They receive an allocation of shares annually. (Where does the money come from to buy the shares?) ESOPs are similar to a leveraged recapitalization. The company borrows money using the business as collateral, and lends to the ESOP, and the ESOP purchases the shares. (Tax benefits?) The seller and the company receive tax benefits. Contributions to an ESOP are tax-deductible. Companies which are 100% ESOP owned are not subject to federal and state income taxes. Thus they have an enhanced cash flow, and can be more competitive, and better able to repay the debt. The selling shareholder can defer capital gains taxes. (What size company is a good fit for an ESOP?) There are annual maintenance costs of an ESOP, so it usually requires a company with at least $10 million in revenue. (10:10)

Preparing adult children to take over the family business.

Mindy Rosenthal is the National Managing Director and Head of the PNC Center for Financial Insight. Regarding passing the business to one’s children: are the children willing to join the business, and prepared to work in the business? The parents can gently expose children to the business, and show pride in the family business. It can be valuable when children work outside the family business. It is important to discuss the plan with the children. A pitfall for some family businesses is when compensation for the children is not at market rate, or if other employees don’t see the successor as qualified. The parents need to be careful to not raise the child too quickly in the business. If the next generation wants to be entrepreneurial, the business can create entrepreneurial opportunities such as new products, new geographies, or new client segments. Complexity can arise when some family members are active in the business and others are not active in the business. There should be open and honest discussion regarding succession, appropriate roles, and speed of succession. Succession within the family does not always work. (10:17)

Selling the family business to a third party.

Sean Cook is an attorney with Warner Norcross and Judd. When selling to a third-party, it is important to make sure that everyone is on the same page. This is especially important for the second generation where there could be many shareholders. Some families have a member of the family be “seller representative.“ A plan can include the goals, and what you want the business to be after the sale. Many families want the “right buyer“ to continue the legacy of the family business and treat employees correctly. Regarding an ESOP, there are tax benefits with the ESOP -- using tax savings to make the transaction work. The selling generation can diversify their financial picture by selling some or all shares. When selling to children, there is the risk of the older generation not getting money for their retirement. Everyone needs their own legal representation. (8:42)

Aug 29

2018

Introduction

Joining the family business at 40 years old.

Interview with Irwin Danto and Ashley Danto Silverman -- third and fourth generation members of the Danto Furniture family business. Charles (Irwin‘s father) is the best sales person, and the owner. Charles gained ownership when his father passed away, and Irwin will gain ownership when Charles passes away. Irwin worked elsewhere before joining the family business. In his twenties he chose to not enter the family business because he saw his grandfather and father in the business, and wondered if there was enough income potential for a third generation. He came to the family business when the store burned down -- to help his father. When Irwin entered the business he was almost 40 years old, and by that time his father showed more respect for him. His father gave him more leeway to take initiatives. It helps to work elsewhere before entering the family business. (7:12)

The next generation “having their say” in the family business.

Ashley started her career in the fashion industry, buying and planning. That helps with furniture buying. (What is it like being a woman in a male-dominated business and industry?) You need to persevere. -- keep speaking up and adding value. Ashley has been active with professional organizations for women. You have to be like a “broken record“ if you have a good idea. (How was Irwin different with Ashley when compared with how Charles treated Irwin?) Irwin: I thought through the challenges of Ashley coming into a family business with her father and grandfather in the business who have a lot of experience, and I have also come to respect Ashley‘s contributions. I let her try things, and maybe I’ll learn something. I have had to second-guess a lot of our traditional beliefs about this store and our customers. (How do you compete with online stores?) We are affected by e-commerce. Larger purchases like furniture require financing and they are more complex. We are doing more social media and digital marketing. Customers come to us through the cloud as well as through the front door. Irwin has won the Spirit of Detroit Award three times. Irwin and Charles helped board up houses during 2008 to 2009. (10:57)

The “how” and “why” of strategic planning.

Interview with Lilly Epstein Stotland, president of Vesco Oil, regarding strategic planning and their recent acquisition of Acculube. (How does Vesco Oil go about strategic planning?) It is easy to get caught up in tactical rather than strategic activities. Strategic planning is a process. We have a physical strategic plan, which we continue to refine. We gather our leadership team on a regular basis and look at what is changing in our industry. We do a SWOT analysis. We look at how we want to change and shape our distribution network. What will be changing and how can we build on our strengths? We saw an opportunity to expand geographically and capitalize on our strengths.

If you don’t complete a strategic plan and continue to refine it, you will be subject to your competitors' plans. Sometimes we formally work on short term and long term objectives which fit into a strategic planning document. We also do daily thinking about how we can move forward. (Implementation of strategic plan?) We have specific goals, with small steps along the way. Employees provide ideas for strategic thinking. We are talking regularly with employees about what is changing in our industry. All of our employees have wonderful ideas. We ask them “What are you seeing? What is changing? What are our competitors doing?" (How is your transition going as the new president?) I am learning that every day I can pass the ball to someone else and let them score. I try to slow down and listen carefully. I want others to succeed personally and professionally. We want to be a company where people want to work. (11:26)

If you don’t complete a strategic plan and continue to refine it, you will be subject to your competitors' plans. Sometimes we formally work on short term and long term objectives which fit into a strategic planning document. We also do daily thinking about how we can move forward. (Implementation of strategic plan?) We have specific goals, with small steps along the way. Employees provide ideas for strategic thinking. We are talking regularly with employees about what is changing in our industry. All of our employees have wonderful ideas. We ask them “What are you seeing? What is changing? What are our competitors doing?" (How is your transition going as the new president?) I am learning that every day I can pass the ball to someone else and let them score. I try to slow down and listen carefully. I want others to succeed personally and professionally. We want to be a company where people want to work. (11:26)

News about local family businesses.

Recent reports indicate that Henry the Hatter is doing better than ever. Last June the store was forced to close after losing their lease – having been in the same location for 65 years. In December, they re-opened in Detroit's Eastern Market. It was recently reported that sales are up 15 percent since the move to the Eastern Market. Paul Wasserman says "It's been a complete positive in revenue, foot traffic and any other way."

The Association for Corporate Growth recently held a panel discussion entitled “Not Your Father's Auto Dealership (Get Big or Get OUT!)” Featured on the panel were: Jay Feldman, President and CEO of Feldman Automotive; David Fischer Jr., President and COO of The Suburban Collection; and Jason Tamaroff, Co-Owner of the Jeffrey Automotive Group. This panel noted that many auto dealer groups are selling their businesses to auto-retail giants or investment firms. The disruption of new technology such as electric, shared and autonomous vehicles have changed the game. Family dealerships are not sure this is a challenge they want their children take on. (5:54)

The Association for Corporate Growth recently held a panel discussion entitled “Not Your Father's Auto Dealership (Get Big or Get OUT!)” Featured on the panel were: Jay Feldman, President and CEO of Feldman Automotive; David Fischer Jr., President and COO of The Suburban Collection; and Jason Tamaroff, Co-Owner of the Jeffrey Automotive Group. This panel noted that many auto dealer groups are selling their businesses to auto-retail giants or investment firms. The disruption of new technology such as electric, shared and autonomous vehicles have changed the game. Family dealerships are not sure this is a challenge they want their children take on. (5:54)

Jul 25

2018

Introduction

Not all family members are welcome to join the family business.

Interview with Ben Maibach III, who served as the third-generation president of the Barton Malow Co., and Ben’s son Ryan Maibach, who became president, CEO and chairman seven years ago. (Values?) A legacy of faith, which comes before business, and business is an opportunity to make an impact on people, and communities where we build. Our selection of projects is guided by our values. Pride in the buildings which we have built, and use. Not just the projects, but our customers have grown and contributed to the communities. We are a privately-held, employee-owned, family controlled business. Individuals in the family are welcome, but they need to have a passion, related degree, and skills for the position. Compromising on this does not help the company. This is different from the way that the first and second generation looked at this. Now that the business has grown, complexity requires this structure. (8:12)

Family business values in action.

(Ben) I was put into my position in 1981 before I was prepared or qualified. That led me to expect future family members to be qualified. This received excellent support from the family. (What led Ryan to enter the family business?) I liked construction. I went with my father and grandfather to the sites. I had pride in what we have built. (How were you prepared to enter the family business?) I grew up around it. I have an engineering degree from Purdue. (Employee ownership?) We empower and delegate. We want them looking at decisions as owners, not as employees. And we want to share in the success of the company. (Reinvention of the family business). The construction industry can be disrupted. It is exciting and daunting to face this challenge. Ryan has transformed the company: revenue, number of employees, culture, getting people on board with the mission, employee satisfaction. (Family?) Ryan, Doug and Ben discuss other family members coming into the business: what issues we should look at, and be proactive. We do not discuss roles, responsibilities, etc. with spouses. They need to be loyal to their husband or wife, and it is a no-win situation. We are constantly learning because the bar is always rising. (10:34)

Next generation leading change.

“People“ comes first in our tagline. How we grow people: careers, lives, dreams. Each project creates opportunities for growth for employees. We get more satisfaction in developing people then we get in building the buildings. (Fifth generation?) Ryan has three children. We talk about the family business at the dinner table. We want to create the opportunity, but not the expectation. There are also nephews and nieces. We welcome those with a passion and credentials. (Passion?) Making something truly successful. Taking that extra step. Doing that extra requirement. A job can be successful or truly successful: it is taking those little extra steps which make something truly successful. (Community?) We have a foundation. We donate 5% of pretax profit for the community. We have employees on the foundation board. We also give in-kind donations. We have a community week where we encourage employees to contribute to the community. (Leading change?) Seven years ago, my transition was not planned. There were challenges in the company, and a sense of urgency. We asked “Why are we here?“ “What is our purpose?“ this translated into an actionable strategy. We had silos in the company, and then transformed to “We are one company.“ We are working collaboratively. Communicating. Engagement of people. Development of people. (9:48)

Leaving talk about the business at the business.

Interview with Juanita Gonzalez-Franco, and her son, Alex Franco. Juanita and Alex are the second and third generation of La Gloria Bakery located in Mexicantown in Southwest Detroit. (Long hours with family?) This can be difficult. We try not to talk about business at home. (Alex decided to join the family business?) I didn’t really have a choice, I came as a child. I dream of continuing the family business legacy. We hope to modernize the business, with new counters and cabinets. (7:37)

Jun 27

2018

Introduction

Formalizing family values.

Robert (Bobby) Schostak has served as the Co-Chief Executive Officer of Schostak Brothers and Company for over 35 years. His son Jeffrey Schostak was recently named president of Schostak Development.

(What values have been most important you?) (Bobby). Our father instilled the values that family comes first, and that blood is thicker than water. We had four brothers born 5 1/2 years apart, so there were a lot of struggles between the boys growing up as children. (Jeffrey). Our values came to us from our grandfather, our father and uncles, and we have now put it to paper and formalized it. Our four core values are: people, integrity, excellence, and entrepreneurial. Our grandfather and great grandfather lived by these values. (How do you define entrepreneurial?) (Jeff). You have to be flexible and opportunistic. And you need to look for opportunities. (Bobby). It’s a matter of being thoughtful, creative, identifying opportunities, being nimble and reactive. It is what put us into the restaurant business, and other new investments for us as a family. It is impossible to separate the business and the family regarding values. (7:33)

(What values have been most important you?) (Bobby). Our father instilled the values that family comes first, and that blood is thicker than water. We had four brothers born 5 1/2 years apart, so there were a lot of struggles between the boys growing up as children. (Jeffrey). Our values came to us from our grandfather, our father and uncles, and we have now put it to paper and formalized it. Our four core values are: people, integrity, excellence, and entrepreneurial. Our grandfather and great grandfather lived by these values. (How do you define entrepreneurial?) (Jeff). You have to be flexible and opportunistic. And you need to look for opportunities. (Bobby). It’s a matter of being thoughtful, creative, identifying opportunities, being nimble and reactive. It is what put us into the restaurant business, and other new investments for us as a family. It is impossible to separate the business and the family regarding values. (7:33)

Making sure that the next generation is prepared.

Jeff is the first to come into the family business with a “track” for development. (Bobby) We started our plans more than 15 years ago on how the next generation would enter the business if they wanted to enter the business. There were no expectations that they enter the business. It’s not automatic. They needed to complete their four year degree and continue to advance their education in their area of interest. We expect them to work at least five years in any industry other than in the family business. Jeff worked in Chicago for more than five years with another real estate company. My nephew Jake worked in two other positions in the restaurant business. After five years they each came in under the mentorship of an uncle, not under their father. (Who are your mentors?) (Jeff) after college, I worked for a real estate development firm for five years. They taught me a lot about business. I moved to the family business 7 1/2 years ago, spending time with my uncle. (How did the third generation bring up the discussion regarding the next generation?) (Bobby) We went to a consultant to help us understand what issues we needed to think about. Then we went to family business education events at the Kellogg School of Management at Northwestern University. We learned about a family council; a family constitution; generational planning; next generation entry into the business. Our goal is to perpetuate this wonderful gift of the family business; transfer it to the next generation; allow a large fifth generation to start to learn about it. We could have liquidated the business, but we want to perpetuate the family business. (Role in the Michigan Republican Party). (Bobby) there was a recession in Michigan. I helped raise funds for the Rick Snyder's campaign. Governor Snyder asked me to be Chairman of the Party. I spent seven years working in Lansing, away from the family business. We transfered away my day-to-day responsibilities in the business. I still had ownership and Board responsibilities. I could have returned to the family business, but I wanted to remain in politics, so I started a political consulting firm. (10:33)

15 years of planning and 10 years of implementing succession.

(Bobby) I worked with Peter Karmanos. We have a venture-capital firm which develops and invests in technology primarily in Michigan. (When Bobby moved away from the family business, did Jeff feel that his development plan was adequate?) (Jeff) I joined the family business in 2010 as my father was getting involved in politics. I worked with my uncle to build my career. (Imagine your family business 10 years from now) (Bobby) We will have a family business with a third or fourth member from the fourth generation. We will always be in real estate. The restaurant business ebbs and flows as we acquire and sell brands. We will see the results of our planning for the next generation. 15 years of planning and 10 years of implementing. We have a Board of Advisors. We are expanding that, and expanding their responsibilities. We will transition from three brothers in the business to cousins in business together. (Jeff) I’m 35 years old. We want to continue to grow the business, and the legacy; being entrepreneurs. Planning for the fifth generation. My wife and I just had our first child. (Community involvement) (Bobby) It is important to contribute not just financially, but also to get personally involved. (8:46)

Implications of the new tax law.

(How will the recent tax reform legislation affect family businesses?) Succession planning. The estate tax amount has increased, so it is easier to transfer ownership of the family business. However, the law is not permanent, and you may outgrow the limits of the estate tax exemption, so it is important to take action now because succession planning for ownership can take many years. (What about owners who are afraid of losing control of the business during succession planning?) Control is a voting issue, and that is different from ownership. You can use nonvoting stock to transfer value without losing control. (How does the new tax bill affect S-corps, C-corps, and partnerships?) There can be long-term implications when changing the ownership structure. (Other opportunities in the tax act?) 100% of capital expenditures can be deducted. (9:22)

May 30

2018

Introduction

“Owners can see things managers do not see.”

Joe Vicari is the CEO of the Joe Vicari Restaurant Group. The restaurant group includes Andiamo, Joe Muer Seafood, 2941 Street Food, Brownies on the Lake, and The Country Inn Restaurant.

How Joe Vicari got involved with Joe Muer Seafood. Operating partners are promoted from managers. “Owners see things managers do not see.“ I was a passive owner in a Ram's Horn restaurant in 1982. I opened the first Andiamo in 1990. (7:44)

How Joe Vicari got involved with Joe Muer Seafood. Operating partners are promoted from managers. “Owners see things managers do not see.“ I was a passive owner in a Ram's Horn restaurant in 1982. I opened the first Andiamo in 1990. (7:44)

We don’t talk about work when at home.

Joe’s wife, son, son-in-law, and brother are in the business. Family members see more than others, and work differently than others. (How have you been able to work with your spouse?) We don’t work together that much in the business, so we are not together every minute. We make a conscious effort to not talk about work all the time at home. I learned from my father “Treat people the way you would like to be treated.“ We have many employees with long seniority in our business. (How do you give feedback to your son?) His mother gives him most feedback. (What is the future of the family business?) We get many opportunities to sell the business. I still have a passion for. We don’t have specific long-term goals. (Do you have a Board?) I am the board. (10:08)

All employees have my cell phone number.

Joe‘s newest venture is 2941 Mediterranean Street Food. It is a quick casual chain of restaurants. Joe is most proud of his reputation. “I tell employees I’m always accessible. All of them have my cell phone number. My door is open. I want to know what’s going on.

News About Local Family Businesses

Planterra is North America’s leading provider of interior landscapes and plant rental services. They were recently featured in a Forbes Magazine blog about their family business. Shane Pliska is president of Planterra. Shane and his brother Zachary did not plan to enter into the family business. It has taken a lot of work to work together effectively as brothers, and only just recently did they “figure it out.“ (What were the challenges?) This is our 45th year in business. We got through the Great Recession, so we had to change our business and change leadership. (How do the brother works work together in business?) Technically my brother reports to me. As president, I have The final say. It took a while to develop so our parents don’t have to be the referee. (Do you have a Board?) Our family members are the board. (9:16)

News About Local Family Businesses

Planterra is North America’s leading provider of interior landscapes and plant rental services. They were recently featured in a Forbes Magazine blog about their family business. Shane Pliska is president of Planterra. Shane and his brother Zachary did not plan to enter into the family business. It has taken a lot of work to work together effectively as brothers, and only just recently did they “figure it out.“ (What were the challenges?) This is our 45th year in business. We got through the Great Recession, so we had to change our business and change leadership. (How do the brother works work together in business?) Technically my brother reports to me. As president, I have The final say. It took a while to develop so our parents don’t have to be the referee. (Do you have a Board?) Our family members are the board. (9:16)

Next gens started at the bottom.

Al Zehnder is Chairman and CEO of Zehnder's of Frankenmuth. He was recently named the 2018 Michigan Small Business Person of the Year. The SBA put in the last piece of financing for Splash Village, which helped us to be a four-season destination. There are four next gens in the family business. We talk a lot about succession planning. We added the next gens to the Board of Directors. They all worked here during high school and college, and started at the bottom. It is important that each of them have worked elsewhere before joining the family business. Other people see you differently. You get a sense of who you are, your strengths and weaknesses. You see what a family business can offer compared to working elsewhere. (8:59)

Apr 25

2018

Introduction

The pain of family relationships can poison every hour of every day.

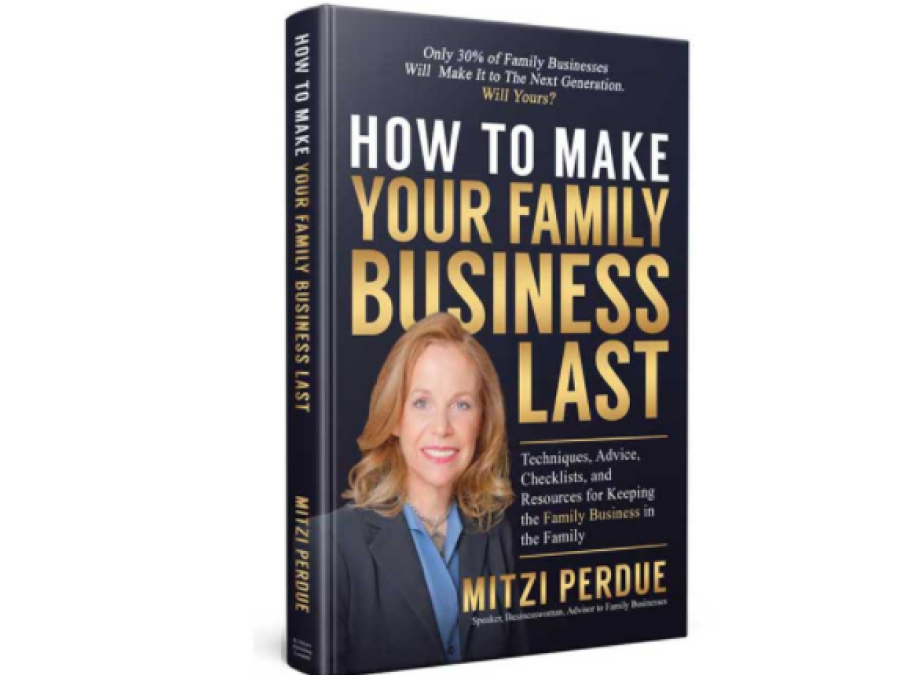

Interview with Mitzi Perdue. Mitzi is the widow of the late Frank Perdue, and the daughter of the co-founder of the Sheraton Hotel Chain. Her biography, Tough Man, Tender Chicken: Business & Life Lessons from Frank Perdue, reached #5 in the Amazon rankings for Business Biographies. She is also the author of several books on family business, including How to Make Your Family Business Last, How to Keep Your Family Connected, and How to Communicate Values to Children so They Will Love It. For more information, go to www.mitziperdue.com

Mitzi Perdue was the keynote speaker at a forum hosted by PNC Wealth Management on May 9, 2018 entitled "Optimize Your Family Business and the Business of Your Family."

(What inspired you to write these books about family business?) My experience with well-known family businesses who had terrible relationships with family members. The pain of those family relationships poison every hour of every day. My family members are my best friends. Why do some families thrive and some blowup? I wrote these books to indicate what works and what leads to blowups. You have to learn that you cannot always be right. Compromise is key. We reward and admire looking at the other side. By the time you let a family quarrel lead to attorneys, it’s almost at the point of no return. So you try to solve problems before the lawyers are involved. (7:58)

Mitzi Perdue was the keynote speaker at a forum hosted by PNC Wealth Management on May 9, 2018 entitled "Optimize Your Family Business and the Business of Your Family."

(What inspired you to write these books about family business?) My experience with well-known family businesses who had terrible relationships with family members. The pain of those family relationships poison every hour of every day. My family members are my best friends. Why do some families thrive and some blowup? I wrote these books to indicate what works and what leads to blowups. You have to learn that you cannot always be right. Compromise is key. We reward and admire looking at the other side. By the time you let a family quarrel lead to attorneys, it’s almost at the point of no return. So you try to solve problems before the lawyers are involved. (7:58)

Teaching values to children.

How can you teach values to children? A family newsletter is a good tool. Every newsletter has something to make the family better. You can focus on values like frugality, resilience, and honesty -- and have these values embedded into stories. You can have activities with costumes, cooking, etc. (How do you deal with conflict?) As children, we were taught to talk about concerns rather than keep them inside. We were taught to not make our quarrels public. We had annual family reunions. We help each other when there are health issues.. (9:21)

Keeping families together after a very difficult decision.

The Henderson family has been intact for over 120 years. How do families remain together after a difficult decision? In 1967, after my father‘s death, we as a family had to decide whether or not to sell the family business. Half of the family felt that we should never sell the family business, and half of the family was certain that it made sense to sell. This was an argument which had to do with our very identity, so there were strong emotions. We were taught to “never wash your dirty linen in public.“ The decision was to sell the family business. We never went to the public or to attorneys. We did not have a public quarrel. Because of this, we could close ranks and stay together as a family. (How do you maintain focus and purpose as a family after the liquidity event?) You need to teach children the values of hard work and frugality, and being productive citizens who contribute. “Put back into the bucket.“ My father was a role model of philanthropy. You build family “glue“ with philanthropy. (9:59)

News about local family businesses

Livonia-based News about local family businesses real estate company Schostak Bros. & Co. has formed a new business unit, Schostak Development, and named Jeffrey Schostak its president. Jeffrey Schostak, 34 years old, is the son of COO Bobby Schostak and grandson of mall development pioneer Jerome Schostak. In 2016, Jeffrey Schostak was a Crain's 40 Under 40 honoree.

Jeff Smith, Chairman and CEO of All Star Services, was recently announced as the National Automatic Merchandising Association’s Operator of the Year as part of the association’s 2018 Industry Awards in Las Vegas. For 31 years, Jeff has led All Star Services, a family-owned vending, coffee service and micro market operation serving Southeast Michigan. Under his leadership, All Star has made seven acquisitions and grown to operate 2,500 vending machines and 60 micro markets across Michigan.

Jeff is the second generation owner of this family business. He works with his wife Suzanne, his children Duncan, Devin and Caroline, and Caroline’s husband Jon Holden.

Jeff Smith, Chairman and CEO of All Star Services, was recently announced as the National Automatic Merchandising Association’s Operator of the Year as part of the association’s 2018 Industry Awards in Las Vegas. For 31 years, Jeff has led All Star Services, a family-owned vending, coffee service and micro market operation serving Southeast Michigan. Under his leadership, All Star has made seven acquisitions and grown to operate 2,500 vending machines and 60 micro markets across Michigan.

Jeff is the second generation owner of this family business. He works with his wife Suzanne, his children Duncan, Devin and Caroline, and Caroline’s husband Jon Holden.

Mar 28

2018

Introduction

Not all family members are created equal.

Interview with Doug Mans, who is the President of Mans Lumber, Anna Mans Motschall, Head of Administration, and Pete Mans, who heads up Operations. How does a family business last for over 100 years? We were taught by our fathers and uncles to treat others the way we wanted to be treated. We saw that this was the way that they behaved. We have been very conservative in our spending and saving. We have been very involved with and close to the needs of our employees and customers.

In our family business you have to decide if you want to work for the family business by the age of 25 years old. We have clearly defined roles in the business. Not all family members are created equal. Sometimes a family business has to make difficult decisions -- not every family member is an executive. We have five owners who have diverse interests and capabilities: finance, sales, and operations. All five family members are hard workers. We are looking forward to the fifth generation coming into the business. We say “It’s your right to work here, it’s not your privilege.“ (8:20)

In our family business you have to decide if you want to work for the family business by the age of 25 years old. We have clearly defined roles in the business. Not all family members are created equal. Sometimes a family business has to make difficult decisions -- not every family member is an executive. We have five owners who have diverse interests and capabilities: finance, sales, and operations. All five family members are hard workers. We are looking forward to the fifth generation coming into the business. We say “It’s your right to work here, it’s not your privilege.“ (8:20)

Surviving economic collapse.

During the 2008 - 2009 economic collapse, our annual revenue went from $80MM to $20MM. We went from 210 employees to 60 employees. We survived because we had been conservative financially. We had deep relationships with employees and customers. We had built customer loyalty over many generations. We reached out to a competitor, to see if there was an opportunity to work together. We decided to join forces.

Home Depot bought property right next-door to our Canton store. We pushed ourselves: "We have to change who we are.” We moved from being a hardware store and lumberyard to being in a show room for builders and homeowners. We meet weekly or by weekly as an ownership team, and go off-site quarterly. We have a 3 year, 5 year, and 10 year plan. This helps us to work ON the business and not just IN the business. This has been a game-changer for us. All of us participate in industry roundtables where we meet with and learn from peers. (11:29)

Home Depot bought property right next-door to our Canton store. We pushed ourselves: "We have to change who we are.” We moved from being a hardware store and lumberyard to being in a show room for builders and homeowners. We meet weekly or by weekly as an ownership team, and go off-site quarterly. We have a 3 year, 5 year, and 10 year plan. This helps us to work ON the business and not just IN the business. This has been a game-changer for us. All of us participate in industry roundtables where we meet with and learn from peers. (11:29)

Game show.

The Family Business Forum "Clashing Cousins" Game Show. (8:30)

“Having a beer with your banker.”

Doug mentioned off the air that during the financial crisis he reached out to work with his banker, PNC, and had “Having a beer with your banker“ meetings. Bankers want to help businesses to be successful. Doug used his banker as a resource rather than fearing his banker. He also reached out to his competitor during the financial crisis. This family business matches family members to positions which best fit their strengths. The core values of this family business: how they treat customers; being fiscally responsible; building relationships with employees and customers. (8:10)

Feb 28

2018

Introduction

Hands-on management.

Interview with Stanford Blanck and Adam Blanck of Wallside Windows. (What is your secret sauce to last into the third generation?) Do whatever you can to take care of customers and employees, and profits will follow. There’s nothing more important to a business than its reputation. This is especially true in the home-improvement industry. We go above and beyond to make sure the customer is satisfied. (How do you make sure that employees hold to these values?) Repetition. Being hands-on. Stanford speaks to all installers and all sales representatives every day so we know about problems. From the top down, there’s a care for the employees We develop a close knit Wallside family, with communication and touch points between leadership and our installation teams, our sales teams, our service teams -- and if there’s an issue, we are there to problem solve and support solutions. These are very informal meetings, but we know what is going on, and if there is an issue we make sure that it is taken care of quickly. We treat our employees as partners. We are willing to work with them to solve problems. We are all in this together. We treat them as a family. We have communication touch points on Facebook that allow everyone to see the end result of their work. Installers post photos of installed windows, so everyone can see the results and the satisfied customers. Our Facebook group includes more than just company activities -- it also includes family events. We want to ensure that everyone feels connected to the company, and they understand we are all in this together, we are all a team. You can have the best window in the world, but if it is not installed properly, it is the worst window. Things inevitably go wrong, and we have a great service team. (10:33)

Introducing change to a 74 year-old business.

(Adam's decision to enter the business). It was great to have experience before entering the family business. The advantages of entering a family business are (1) being part of a legacy bigger than myself; (2) this is a great opportunity to see what we can do to keep these values into the next generation; (3) working with my father and uncle every day. The disadvantages are (1) being with family all the time -- you need your own time; (2) how do you make change in a business that is 74 years old? It takes patience to lead change. I’m not the only one leading change. We involve everyone, who often know Wallside better than I do. I ask “ What are your challenges?” We solve the problems they see every day, to make their lives better along with the company. Adam is a manager for employees who have been at the company since before he was born. Adam has introduced technology into Sales. They have taken it well. You have to sell them on it, and approach it mildly. There are no family members other than Adam in the business. This makes transition a lot easier, but also puts a lot more pressure on Adam to continue the legacy. (10:33)

Game show.

Laurie Bramson and Michael Ciranna of the Contract Source Group join Stanford and Adam Blanck to play the "Family Business Generation Joust" Game Show. (The Contract Source Group is a customer-driven representative of contract furniture manufacturers for commercial, healthcare, hospitality and office markets.) (7:15)

Lessons learned from the show.

Focus on values -- Focus on customers and employees, and the money will follow. Build a great place to work. Communication touch points with employees. Listening to employees: "What can we do to make the company better?" A Facebook group where employees interact with each other -- and can post photos of employee parties and personal photos. (7:50)

Jan 31

2018

Introduction

Why auto dealerships remain in the family.

Recorded at the 2018 North American International Auto Show

Interview with Mark O'Brien (3rd generation) and his son Sean O'Brien (4th generation) from Roy O'Brien Ford. Most dealerships are passed to the next generation because of the huge investment required to break into the business. In dealerships, members of the next generation are sent to NADA classes; they need to be of good character; and active in the community. Now Ford Motor Company has more requirements in order to pass the business to the next generation. Sean went to law school and practiced law for four years. Then his father and uncle asked him if he was interested in entering the dealership. Sean had a concern that other employees would feel that he was gifted the position. After several positions in the dealership, Sean is now the Used Car Manager. The role of technology inside the car; Uber and Lyft; hands-free driving etc. are all things which dealers will have to adapt to. (9:23)

Interview with Mark O'Brien (3rd generation) and his son Sean O'Brien (4th generation) from Roy O'Brien Ford. Most dealerships are passed to the next generation because of the huge investment required to break into the business. In dealerships, members of the next generation are sent to NADA classes; they need to be of good character; and active in the community. Now Ford Motor Company has more requirements in order to pass the business to the next generation. Sean went to law school and practiced law for four years. Then his father and uncle asked him if he was interested in entering the dealership. Sean had a concern that other employees would feel that he was gifted the position. After several positions in the dealership, Sean is now the Used Car Manager. The role of technology inside the car; Uber and Lyft; hands-free driving etc. are all things which dealers will have to adapt to. (9:23)

There is one driver seat in the business.

Mark realizes that it is the next generation that will take the leadership with respect to technology and connectivity. Mark’s younger brother Roy Patrick O’Brien is the General Manager. They have a full-time social media person. They would not hire someone who they would not want to invite for Thanksgiving. There is one driver seat in the business, and Roy Patrick O’Brien has that seat. There cannot be two drivers. At work, the family members are coworkers, not family. They leave family matters at home, and treat it like a business. Sean started at 12 years old in maintenance and new car prep, and worked every summer. Sean learned from his father that you have to earn the respect of employees and not demand it. Roy O'Brien is closed on the weekend. They can attract high caliber employees by giving a two day weekend. They are creating a family environment. (10:01)

Earning the respect of employees.

Interview with Bill Golling (2nd generation), President of the Golling Automotive Group, and his son Michael Golling (3rd generation). Bill is also Vice Chair of the 2018 North American International Auto Show. Mike has to earn the respect of the employees, especially as the dealer's son. You have to work the hardest and do the best job. As a teenager, Mike wanted to enter the business. He worked at the dealership during his college years. Bill learned from his father that he had to earn the respect of employees through hard work. Bill makes sure that his sons report to a manager, and not to their father. The sons also will not report to each other. Bill told the managers that he would back their discipline of his sons. Mark and his brother Matthew meet every week for a “brothers lunch". They talk about business and family. The brothers teach their father about new technology which can be used in the store. (9:49)

Game show.

The "Family Business Generation Joust" Game Show. (7:32)